-

Business Setup

For Foreign Companies

For Indian Companies

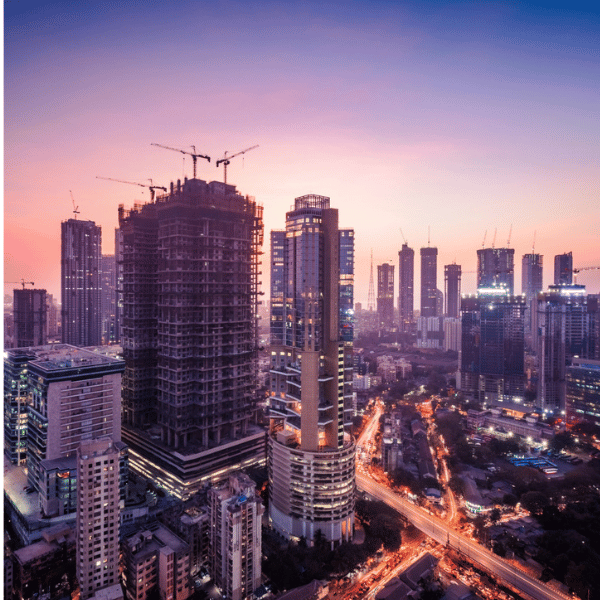

GIFT City

- GCC Setup

-

Corporate Services

Taxation Services

Advisory & Regulatory

Accounting Services

- Who We Are

- Contact Us